Here, in this guide, I will try to provide you with a detailed explanation of “What is Cross Cheque? Types of Cross Cheque.”

What is Cross Cheque?

Crossing of a cheque is generally used for giving instruction to the bank to pay the specified sum of money written in the Cheque directly to the bank account of the payee.

A cheque can either be open or crossed. An open cheque is payable over the counter on presentment by the payee by the paying banker. While a crossed cheque is not payable over the counter but it shall be collected only through a banker. The amount payable for the crossed cheque is transferred to the bank account of the payee.

An open cheque can be crossed by drawing two parallel transverse lines on the left upper corner of the cheque.

Read Also: What is Endorsement of a Cheque? A Complete Guide for How to Endorse a Cheque.

Types of Crossing of a Cheque

Usually, we are practicing two types of crossing;

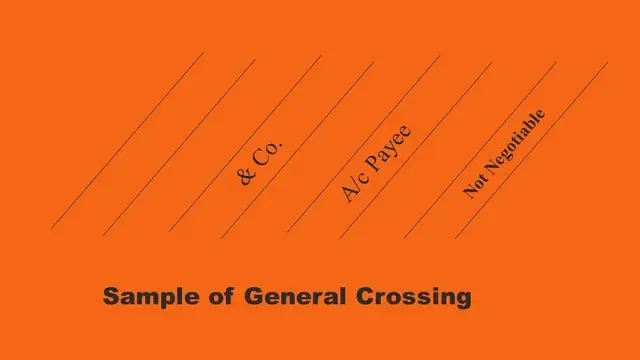

a. General crossing

b. Special crossing

a. General crossing

N.I. Act-1881: Section-123

Where a cheque bears across its lace an addition of the words ” and company” or any abbreviation thereof, between two parallel transverse lines, or of two parallel transverse lines simply either with or without the words not negotiable’, that addition shall be deemed as crossing and the cheque shall be deemed as crossed generally.

b. Special Crossing

N.I. Act-1881: Section- 124:

Where a cheque across its face an addition of the name of a banker, either with or without the words not negotiable’ that addition shalt be deemed a crossing and the cheque shall be deemed as crossed specially, and as crossed to that banker.

This type is used for the Clearing house and for collection of cheques outside Clearing house.

Along with the earlier mention of two types of crossing, we also found the following crossing in practice;

C. Double Crossing

Where a cheque bears two separate special crossings, it is said to have been doubly crossed.

N.I. Act-1881, Section-127:

Where a -cheque is crossed specially to more than one banker, except when crossed to an agent for the purpose of collection, the banker on whom it is drawn shall refuse payment thereof.

Double crossing is when a bank to whom the cheque crossed specially, further submits the same to another bank, for the purpose of collection as its agent, in this situation the second crossing should indicate that it is serving as an agent of the prior banker, to whom the cheque was specially crossed.

D. Not Negotiable Cheque Crossing

As per section 130 of the Negotiable Instruments Act, 1881 a person taking a cheque bearing a general or special crossing with the words ‘not negotiable’ will not have and is neither capable of giving a better title than that which the person from whom he took it had.

One of the important features of a negotiable instrument is that a person who receives it in good faith, without negligence, for value, before maturity and without knowing the defect in the title of the transferor, gets a good title to the instrument.

Mode of Payment of Crossed Cheque

When a cheque is crossed generally, the banker on whom it is drawn shall not pay it otherwise than to a banker. When a cheque is crossed specially, the banker on whom it is drawn shall not pay it otherwise than to the banker to whom it is crossed, or his agent for collection. (Section- 126)

Who can cross a Cheque?

Drawer: The drawer can make general or special crossing on a cheque at the time of drawing or issuing it.

Holder: Where a cheque is uncrossed, the ‘holder may cross it generally or specially. Where a cheque is crossed-generally, the holder may cross it specially (Section-125).

Banker: Where a cheque is crossed specially, the banker to whom it is crossed may again cross it specially: to another banker, his agent, for collection.

When an uncrossed cheque, or a cheque crossed generally, is sent to a banker for collection, he may cross it specially to -himself (Section- 125).

Opening of a Crossed Cheuqe

Cancellation of crossing of a cheque is called opening of crossing. The cancellation can be done only by the drawer of the cheque. The drawer will put his full signature with the words ‘pay cash’ at the space where crossing is made.