When we apply for a loan to a bank or a financial institution and submit all required documents for the proposed loan we came to know that bank will forward our proposal after getting a clean CIB report. Though we have a bit of knowledge about loan procedure we merely know about what is CIB report in bank and why a CIB report is needed for decision making in providing loans for the bank and other financial institutions.

In developed countries, banks or financial institutions use a variety of techniques to justify the eligibility of getting a loan of the applicant. But in our country, CIB report is the primary and only official procedure for verifying the creditworthiness of the applicant. Here, I’m going to discuss the information covered in a CIB report and the importance of CIB before approving a loan to a borrower.

RAED ALSO: What are the Seven core risks in the Banking Sector of Bangladesh?

For determining the trustworthiness of a borrower or applicant, Bangladesh Bank, the central bank of the country, develop a central credit database named Credit Information Bureau (CIB) in 1992 to analyze the repayment capacity and previous loan behavior of the applicant. The main objective of the Credit Information Bureau (CIB) is to make the customer selection procedure easier for banks or financial institutions as well as other lenders.

Benefits of CIB report in Bank:

01. CIB helps minimize the amount of default or bad loans by providing timely reports about credit information based on the inquiry/request about the loan applicants to mitigate the credit risk of banks or financial institutions.

02. In the competitive market, banks are usually intended to disburse loans to the applicant based on their borrowing capacity and good repayment history. With the help of CIB reports, banks or financial institutions have been able to cut off loan-processing time, costs and default loans to a significant level.

03. Verbal information exchanges help banks or financial institutions to identify good borrowers. However, the practical consequence is CIB helps for better risk management, which enables banks and FIs to avoid risky large loans and increase their lending volume to small and medium-sized enterprises (SME.

04. Credit reporting to CIB database by banks or financial institutions make possible of proper sharing of credit information which also helps to take proper decision in lending, avoid defaulted borrowers as well. Which, in a broad sense, reduces default rates for particular banks/financial institutions as well as countries.

05. CIB report is especially useful when banks and Financial institutions make lending decisions to individuals and SMEs. While lending to large companies, a detailed analysis of the potential borrower’s financial capability and payment history is found to be a sufficiently good predictor of the probability of default of those companies.

It is agreed that the CIB report helps to reduce the ex-ante cost and time of loan processing and the ex-post rate of default, which encourages banks to report credit information to the CIB database.

CIB report analysis:

Bank or financial institution by providing basic information to BB in provided prescribed form about their customer gets credit information of customers for disbursing a loan. Bank or Financial Institutions processes CIB data of applicants by dividing them into two categories;

01. Individual Information

02. Proprietorship or Company Information.

For individual information, valid NID is mandatory for CIB reports. Besides NID other valid documents like Passport, Driving license, Birth Certificate, etc.

And for Proprietorship or Company Information valid NID of owner/Mandate holder/Authorized signatory/Managing Director/Chairman etc. along with trade license/Memorandum and Articles of Association (certified by RJSC) is required for CIB reporting.

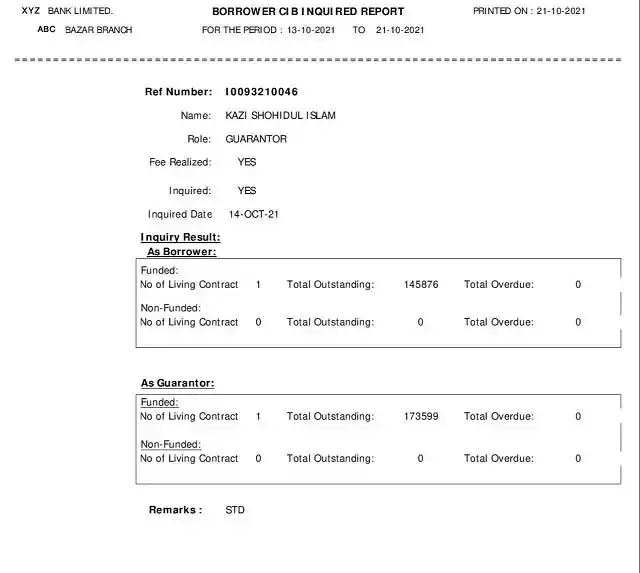

A CIB report comprises of;

01. Reference number.

02. Name of the applicant. (Individual or Organization)

03. Role of the person inquired in CIB.

04. Number of loan facilities exist in the personal name and name of the organization operated by the applicant as borrower or guarantor.

05. Total outstanding amount if any loan exists in the name of the applicant as borrower or guarantor.

06. Total overdue amount if any loan exists in the name of the applicant as borrower or guarantor.

07. Account status as NIL (No loan exists), STD(Standard), SMA (Special Mentioned Account), DF(Doubtful), BL (Bad Loss) etc.

Confidentiality of CIB report:

In article 46 of Bangladesh Bank Order, 1972, there are directions and guidance for the restricted use of credit information. In this article, restrictions are also imposed for not to disclose any credit information to the clients or others. Furthermore, in this article, it is also said that even Bangladesh Bank and other commercial banks/FIs are not entitled to disclose or transfer any complete credit information of borrowers.

The fundamental obligation of the Credit Information Bureau (CIB) is to generate ‘trust’ among its banks/FIs and borrowers so that borrowers’ information is not mishandled or abused. All the banks/FIs should, however, have to maintain confidentiality in the CIB. This trust motivates banks/FIs to contribute their credit information to CIB and helps it to develop more rapidly and effectively.

In case the CIB report in respect of the borrower/customer is found adverse, instead of handing over the CIB report itself or an extract thereof, the banks/FIs may inform the client or prospective client in writing, in a confidential letter using the following language:

“According to credit information available with us, you are identified to be in default in your account(s) with one or more lending institution(s). You may approach your current lending institution(s) to regularize the position with them.” (CIB Circular 1 dated 08 January 2005).

CIB report Fees & Charges:

For a loan, the applicant has to submit information and a guarantee of his/her spouse along with a prime guarantor. Mostly three persons guarantee needed for a loan. So, CIB report is mandatory for these three person bank charges Tk.300/-(May vary from bank to bank) for each person CIB inquiry. Among this Tk.300/- there is a share of Bangladesh Bank and the rest taken by CIB inquiry initiating Bank/FIs.

Bangladesh Bank Guidelines for CIB:

FAQs:

01. What is the purpose CIB reporting?

The Credit Information Bureau (CIB) of Bangladesh Bank is for providing credit related information about individuals or organizations which is collected from Bank/FIs monthly basis and this information is concrete and reliable for Bank/FIs for making decisions regarding disbursing a new loan or renewal of an existing loan.

02. Is CIB report mandatory for each loan?

Each and every loan applied to the bank required CIB report before disbursing a new loan. Some Financial institutions like IDLC, IPDC, etc inquired CIB report for giving a new loan.

03. How many days a CIB report is Valid for?

CIB report is valid for two months. If a CIB report inquired and inquired date exceeds two months a fresh CIB report is mandatory before disbursement of a loan.

04. Is NGO required CIB report for a new loan?

No, till now NGO does not inquire CIB report for disbursing a new loan.

Which CIB status accepted for getting loan?

If CIB status STD(Standard) bank will proceeds your loan application.

My CIB status is bad. But in the mean time i close my loan. Now i have no overdue in any bank. Now when i can apply for loan or when bangladesh bank clean my CIB status?

Usually, it takes 01 or 02 months to update CIB status. You can also convince bank officials regarding your loan status by showing account statement of your closed account.

ব্যাংক এর ঋণ এর জন্য আবেদন করলে কাস্টমার এর যদি NGO তে ঋণ থাকে সেই Ngo এর ঋণ গুলা কি CIB report এ আসবে।