At the end of the year 2022 a number of state-owned and private banks announced their operating profit which portrays a significant growth in the midst of a series of loan-related scams in the country’s banking system though the world has to face the adversity of COVID-19.

A 10-25% growth in operating profits was reported by both public and private commercial banks over the past calendar year. The operating profit is the key indicator of a bank’s financial and infrastructure health that leads to further decisions by the bank.

Read Also: Bangladesh introduces “Binimoy”, The new Interoperable Digital Transaction Platform.

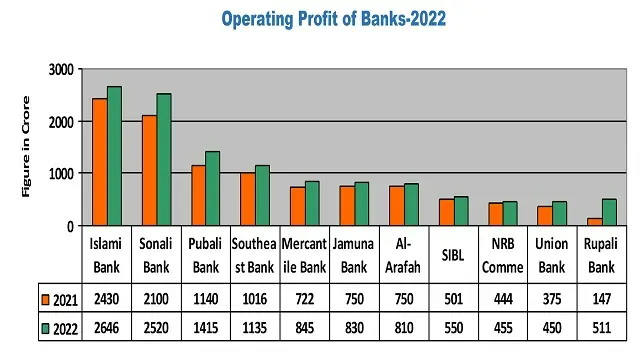

The following is a list of Operating profit of banks shared by few major banks in our country;

In the graph, Rupali Bank Limited achieves the highest percentage among the listed banks over 43-percent growth. Its earnings increased to Tk 364.00 crore from the year 2021.

Union Bank stood second with a 25 percent growth as the private commercial bank earned operating profits amounting to Tk 75.00 Crore in the just-past year

Sonali Bank Limited becomes third-largest profit-earning bank. Sonali Bank Limited growth raises around 20 per cent from the year 2021. Sonali Bank Limited recording Tk. 2,520.00 Crore crore in 2022 in a rise from Tk 2,100.00 crore a year before.

The Jamuna Bank Limited secured 18.57 percent growth in making operating profit of Tk 830.00 Crore in the just-concluded year 2022. Whereas its operating profit in the last calendrer year was tk.750.00 Crore.

In the list Mercantile Bank Limited got positioned in the fifth position with a 17 percent growth after achieving Tk.845.00 crore in 2022 though in 2021, the bank’s operating profit was recorded Tk.722.00 crore.

Southeast Bank Limited managed to earned over 11 percent growth in the past calendar year with Tk 1,135.00 crore earned as operating profit. In 2021, the figure was Tk 1,016.00 crore.

Social Islami Bank Limited (SIBL) earned Tk 550.00 crore as operating profits in 2022 and the figure jumped by Tk 501.00 crore from the 2021 earnings.

Islami Bank Bangladesh Ltd (IBBL) registered unaudited profit worth Tk 2,646.00 crore, up by around 9.0 per cent from the previous year’s Tk 2,430.00 crore as stands in the 1st position of achieving highest operating bank in our country though the bank is in the middle of scam.

Pubali Bank Limited secured 24.12 percent growth in making operating profit of Tk 1415.00 Crore in the year 2022 whereas their operating profit in the year was tk.1,140.00 crore.

Operating profits of Al-Arafah Islami Bank Limited increased by to Tk 810.00 crore in 2022.

According to data from the Bangladesh Bank, total disbursed loans in the country stood at Tk14.36 lakh crore till September this year. Of this, defaulted loans are Tk.1.34 lakh crore which at the end of June was Tk1.25 lakh crore.

A number of banks could not make happen to achieve their set target for the year 2022 because of two factors – dollar appreciation amid the greenback shortfall and government belt-tightening measures as said by the top executive of those banks. To meet the foreign-currency obligations, all the banks were forced to buy dollars at higher rates to clear import bills that ate up a portion of their profits while austerity measures to protect the reserves compelled them not to go for import.

Source: Daily Newspaper.