Pubali Bank Limited entered the digital banking era by introducing its mobile banking apps PI Banking. They are trying to connect with all types of customers with digital Banking and provide their services to doorsteps. In this trend, they collaborate with another giant mobile banking service “BKASH”. Now any Pubali Bank Limited account holder can Add Money through PI Banking apps to any bKash Account whenever they want. With the Pubali Bank Limited app “PI Banking”, anyone can perform the fund transfer transaction simply through the login option of his/her PI Banking. Now fund transfer will occur in an instant! Just you have to register with PI Banking Apps.

Read Also: How to use PI Banking apps of Pubali Bank?

Main Features of Add money service through PI Banking apps

To add money Bank account holder can transfer funds either add bKash account(s) by adding beneficiary via the mobile App, or without adding a beneficiary.

Process of Add beneficiary via PI Banking Application

For adding beneficiary bKash account holder, after successful registration with PI Banking Application Account holder have to Log into “PI Banking”.

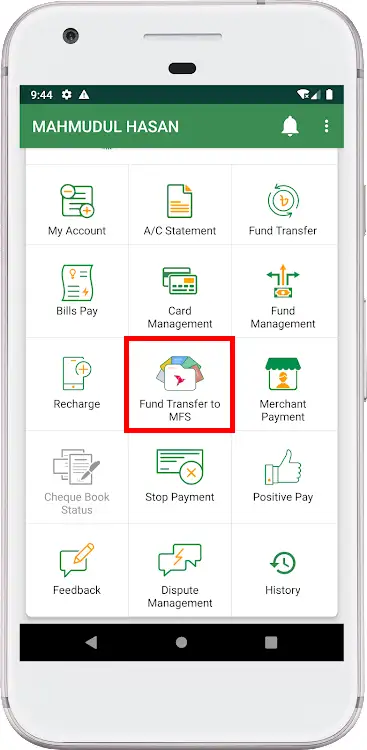

– Then go to Fund Transfer to MFS > Show Beneficiary Account > Add Beneficiary.

– Enter valid bKash Account Number & Short Name >Click to submit and beneficiary will be added to the available beneficiary list.

– If the added beneficiary needs any modification, the customer needs to select the particular beneficiary, delete the beneficiary, and add again with updated information.

– By using PI Banking, senders can transfer funds to any bKash customer account, authorized by using their credentials.

Procedure for Add Money through PI Banking apps:

You cannot add money directly from bKash app add money service. To add money from an account of Pubali Bank Limited, you have to log in to your bKash App and select Pubali Bank from (Bank to bKash’s internet banking) or directly log in to your PI Banking App and access your bank account.

– Then Click Fund Transfer to MFS >Select bKash > Select Phone Number from contact list/ beneficiary list/ enter a bKash number >Select Source Account > Enter Transfer amount> write particulars (Description)> Click to Process.

– After OTP Verification, a confirmation screen will appear. After verification click on the confirm button.

– Upon successful validation, the customer’s bKash account will be credited.

– On failure, Pubali Bank users will get failure notification; bKash customers will not receive any notification.

– bKash customer will identify the transaction as ‘Bank to bKash’

– SMS: You have received a deposit of Tk. 30,000 from Pubali Bank Fee Tk. 0.00. Balance Tk. 200,000. TrxID XXXXXXXXXX at dd/mm/yyyy hh:mm

Terms and Conditions

- Senders must have a Pubali Bank Limited account and a complete Internet Banking registration process for the mobile banking app “PI Banking”.

- Receiver needs to have a registered bKash customer account.

Fees & Charges

– Till now No Fees & Charges imposed by both Pubali Bank Limited and bKash authority. Its totally free of cost.

Transaction Limit

– Transfer to bKash account: Limit is merged with Cash in Limits for the beneficiary/bKash account holder.

– Transfer from Pubali Bank Ltd. Mobile Banking App “PI Banking”: Currently the transaction limit is Tk. 30,000 per day, and Tk. 200,000 per month for an individual customer

– Transfer and transaction limit for a single bKash number:

Transaction LImits | ||||||

Transaction Type | Maximum Number of Transactions | Amount Per Transaction | Maximum Amount | |||

Per Day | Per Month | Minimum(Tk) | Maximum(Tk) | Per Day | Per Month | |

Cash in from Agent | 5 | 25 | 50 | 30,000 | 30,000 | 2,00,000 |

Deposit from Bank to bKash | ||||||

Card to bKash | ||||||

Send Money & Transfer Money | 50 | 100 | 10 | 25,000 | 25,000 | 2,00,000 |

Mobile Recharge | 50 | 1,500 | 10 | 1,000 | 10,000 | 1,00,000 |

Payment | No Limit | No Limit | 1 | No Limit | No Limit | No Limit |

Cash Out from Agent | 2 | 20 | 50 | 25,000 | 25,000 | 1,50,000 |

Cash Out from ATM | 3,000 | |||||

International Remittance | 10 | 50 | 50 | 1,25,000 | 1,25,000 | 4,50,000 |

FAQs:

01. Can any account holder add money from an account of Pubali Bank Limited?

Yes, but those who have access or are registered with Pi Banking Apps only they can Add Money from an account of Pubali Bank Limited.

02. Is add money service from Pi Banking Apps to bKash?

Yes, add money from Pi Banking (Pubali Bank Limited bank account) Apps to any bKash is fully free.

03. Is there any limit for add money from Pi Banking Apps to bKash?

Currently, the transaction limit is Tk. 30,000 per day, and Tk. 200,000 per month for an individual customer.